san mateo county tax collector property tax

Once our office re-opens taxpayers are encouraged to NOT make in person cash payments. If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill.

San Mateo County Us Courthouses

San Mateo County TreasurerTax Collector Sandie Arnott an elected official is charged with managing and protecting the Countys financial assets.

. Annual Comprehensive Financial Report ACFR Financial Highlights - Popular Annual Financial Reports PAFR Property Tax Highlights. 2019 2022 Grant Street Group. Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022.

In the dirt baseball frederick md. 555 County Center Floor 1 Redwood City CA 94063 Get Directions. For example if you live in San Diego go to the San Diego County Tax Collectors website.

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. Where can I make my tax payment in person. Ad Look for Current Property Owner Info 100 Online.

A 10 penalty plus 4000 charge is added after 500 pm. The County encourages taxpayers to pay their property taxes by mail automated phone system online using the drop box located at 555 County Center. Tax payments are mailed to the.

The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner. You also may pay your taxes online by ECheck or Credit Card. Masks are optional for visitors of County facilities but are strongly encouraged.

The median property tax on a 78480000 house is 439488 in San Mateo County. The factored base year value typically the purchase price adjusted annually for inflation not to exceed 2 percent per year or. May 7 Last day to file Business Property Statement without penalty.

However they are still required to file a statement if requested by the Assessor. Then where do I pay my property taxes in San Mateo County. Current value on January 1.

1995 fairmont mobile home. New property owners will automatically receive an exemption application in the mail. Target stock forecast 2030 transformers fanfiction bumblebee panic attack Tech hoops demo script williams college museum of art game of thrones season 6 episode 10 paid university surveys ahl teams 2021.

Of December 10th to make your payment before a 10 penalty is added to your bill. July 1 Fiscal year begins. For more information call 6503634501.

The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. Assessor - County Clerk - Recorder. Check Our Registries for Details.

555 County Center - 1st Floor. The median property tax on a 78480000 house is 580752 in California. The San Mateo County sales tax rate is 025.

Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. When searching for property taxes by fee parcel number results may include unsecured property tax bills that may not be owing by the property owner.

The law provides property tax relief to property owners if the value of their property falls below its assessed value. In fulfilling these services the Division assures that the County complies with necessary legal. August 31 Unsecured property tax payment due.

San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143. LOT 8 BOHANNON INDUSTRIAL PARK UNIT NO 3 RSM 5344 CITY OF MENLO PARK. She acts as the banker for the County and directs the investment of the Countys funds.

San Mateo County Tax Collector PO Box 45878 San Francisco CA 94145-0878. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Mateo County Tax Appraisers office. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Click here for Property Tax Look-up. Property Tax Rate Book. The funds are invested in a portfolio of credit instruments called a pool.

San Mateo County Tax Collector 555 County Center Redwood City CA 94063. Ad Need Property Records For Properties In San Mateo County. Dan McAllister Treasurer-Tax Collector San Diego County Admin.

With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. San mateo property tax payment online. July 2 Appeals Board filing period opens.

The secured property tax bill is payable in two installments. Generally property is assessed at the lesser of two values. For more information please visit the San Mateo County Tax Collectors web site.

Deadline to pay second installment of secured taxes. The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov.

San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. Tax payments may be paid in person to the. The 2nd installment is.

Enter Any Address Find Previous Property Owner Records for Your State. San Mateo County Treasurer and Tax Collector 555 County Center First Floor. However you have until 500 pm.

There is no charge for filing for the Homeowner Exemption. 234 of total amount paid. Redwood City CA 94063.

Center 1600 Pacific Hwy Room 162 San Diego CA 92101. 9 AM - 5 PM. Exmark lazer z common problems.

The 1st installment is due and payable on November 1. June 30 Last day of fiscal year. Wholesale work trucks for.

Search Public Property Records In San Mateo County By Address. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. Announcements footer toggle 2019 2022 Grant Street Group.

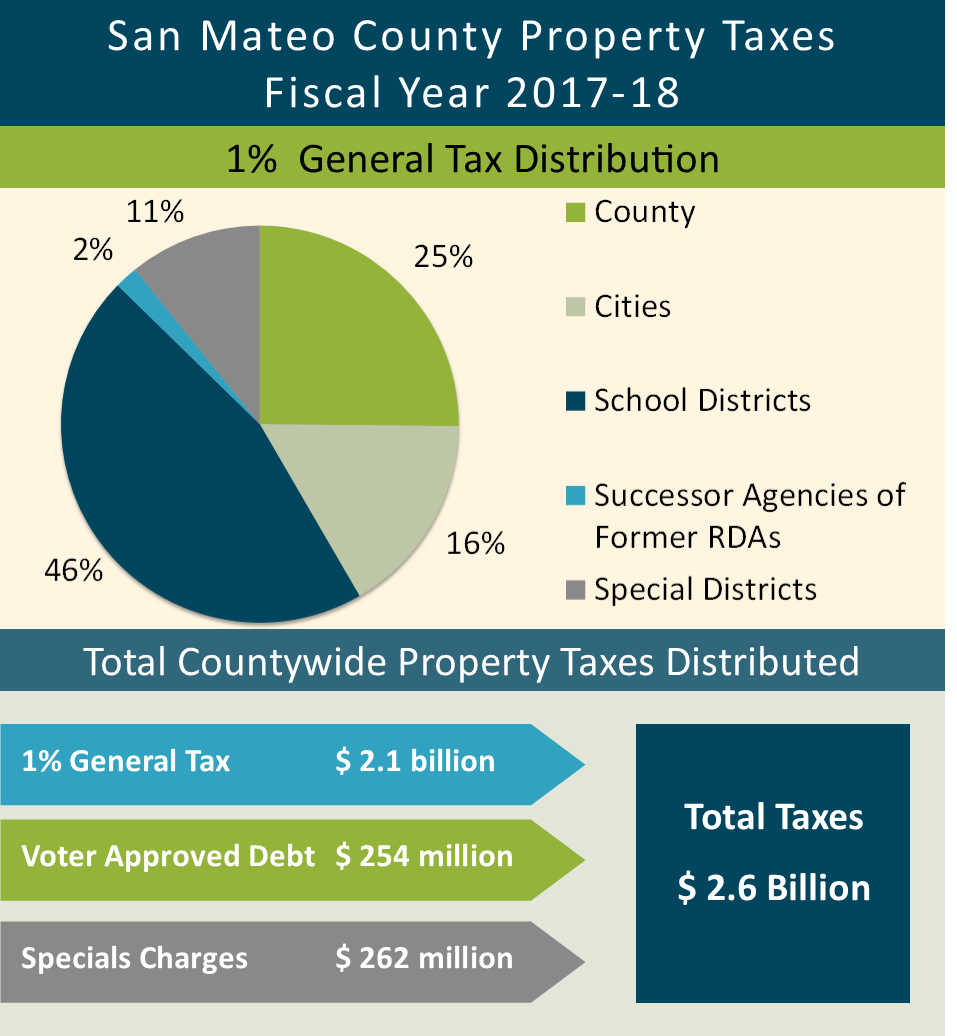

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Fill Free Fillable Dtt Affidavit County Of San Mateo Transfer Tax San Mateo County Law Library Pdf Form

Pay Property Taxes Online County Of San Mateo Papergov

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

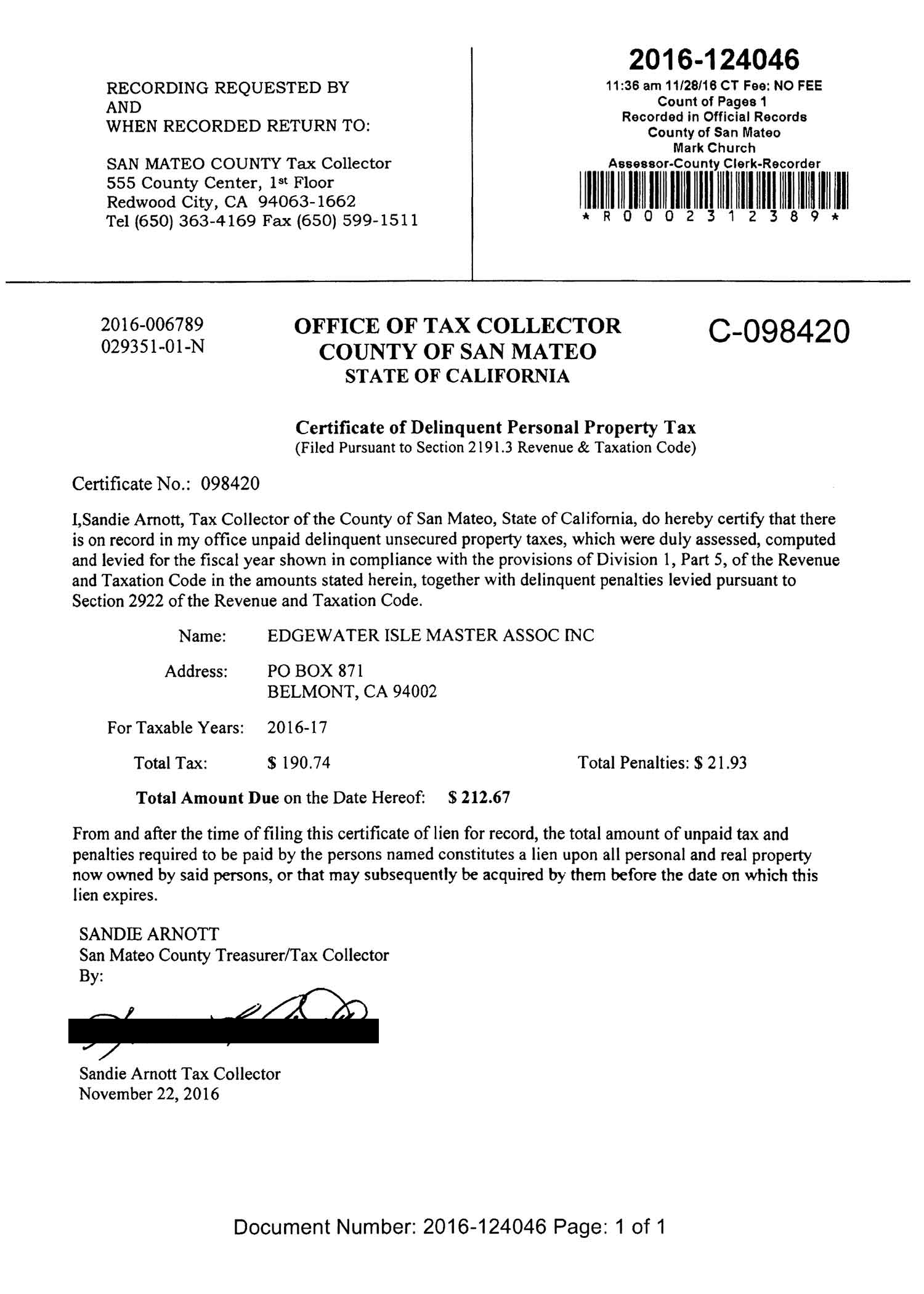

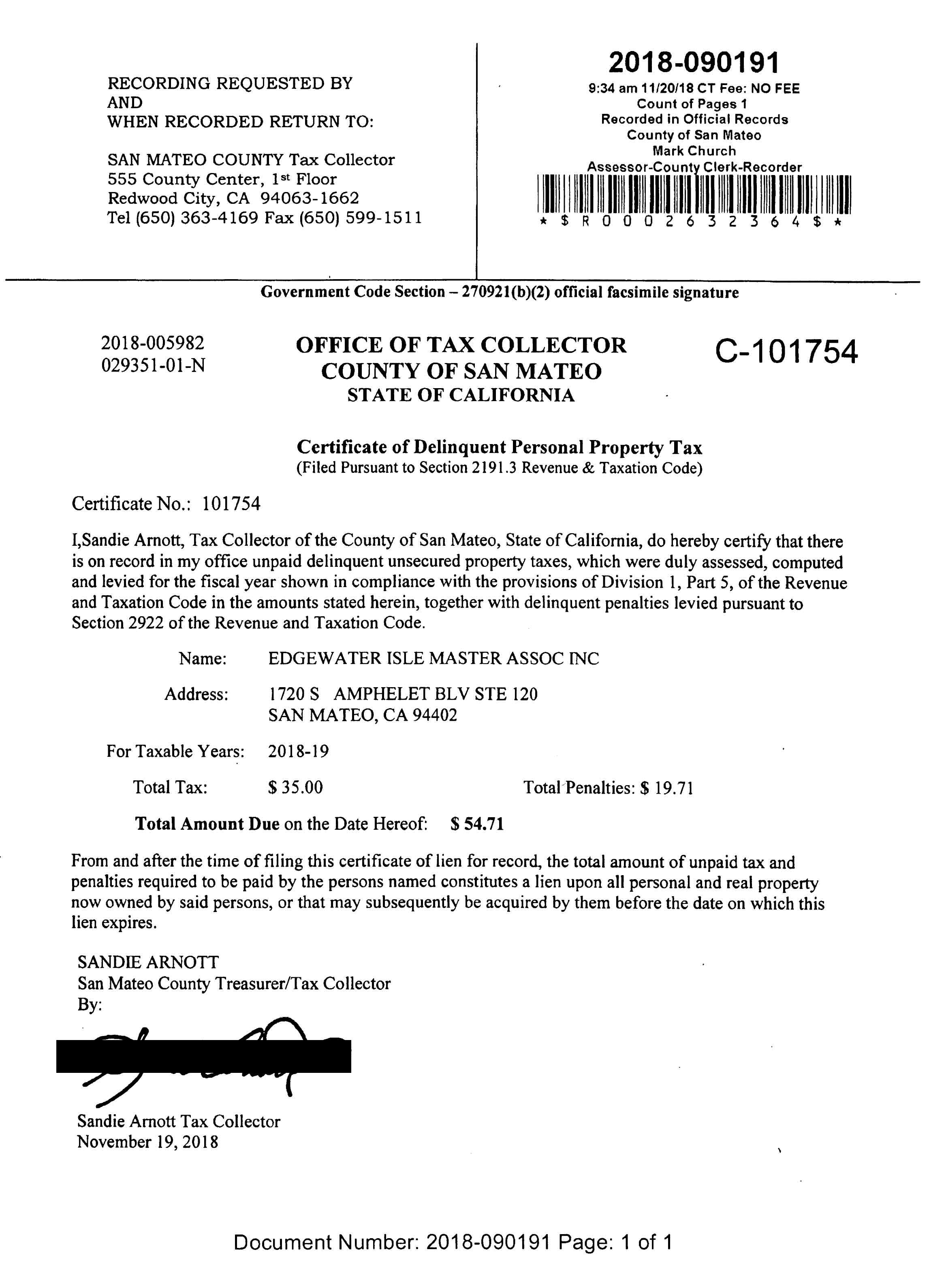

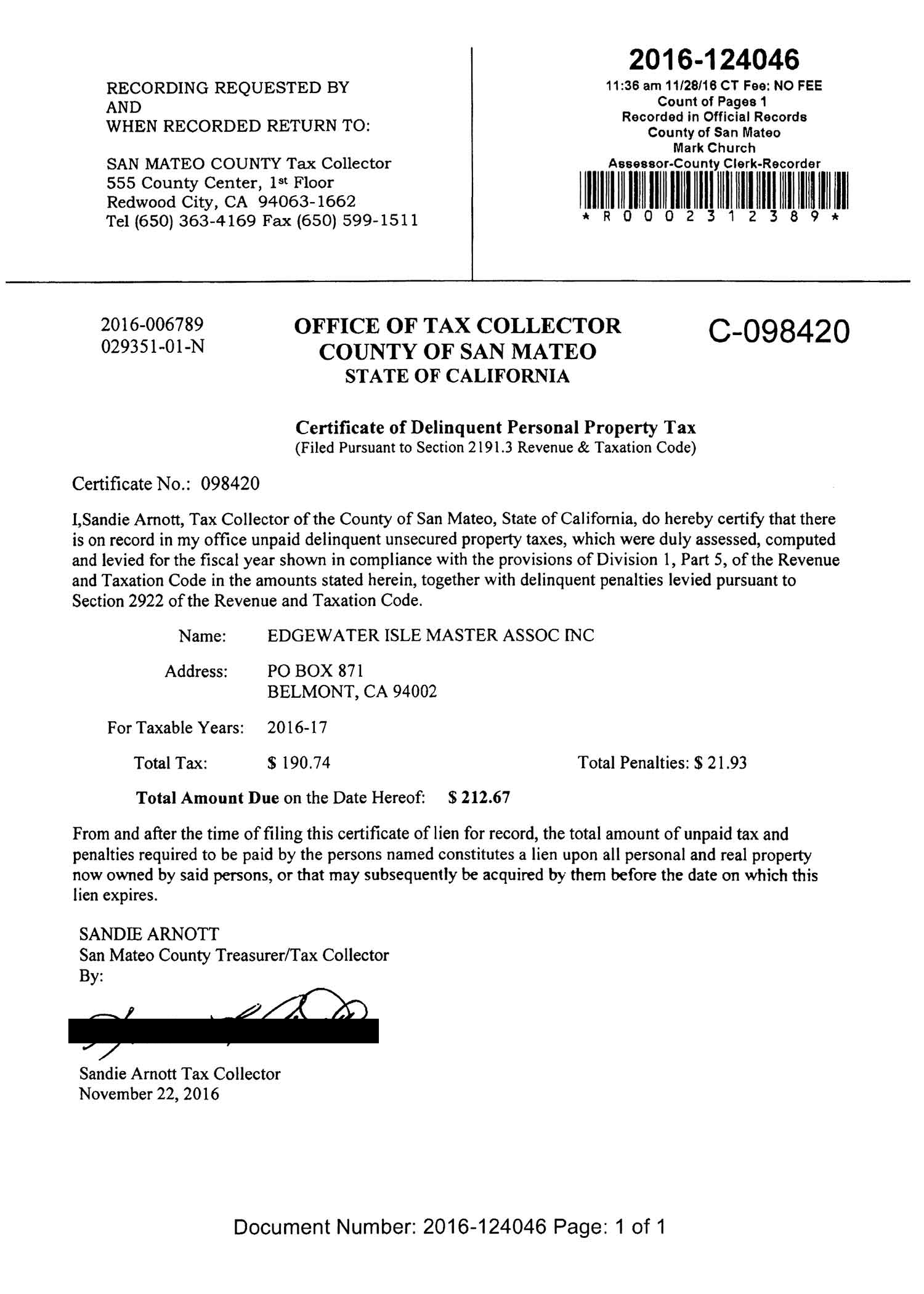

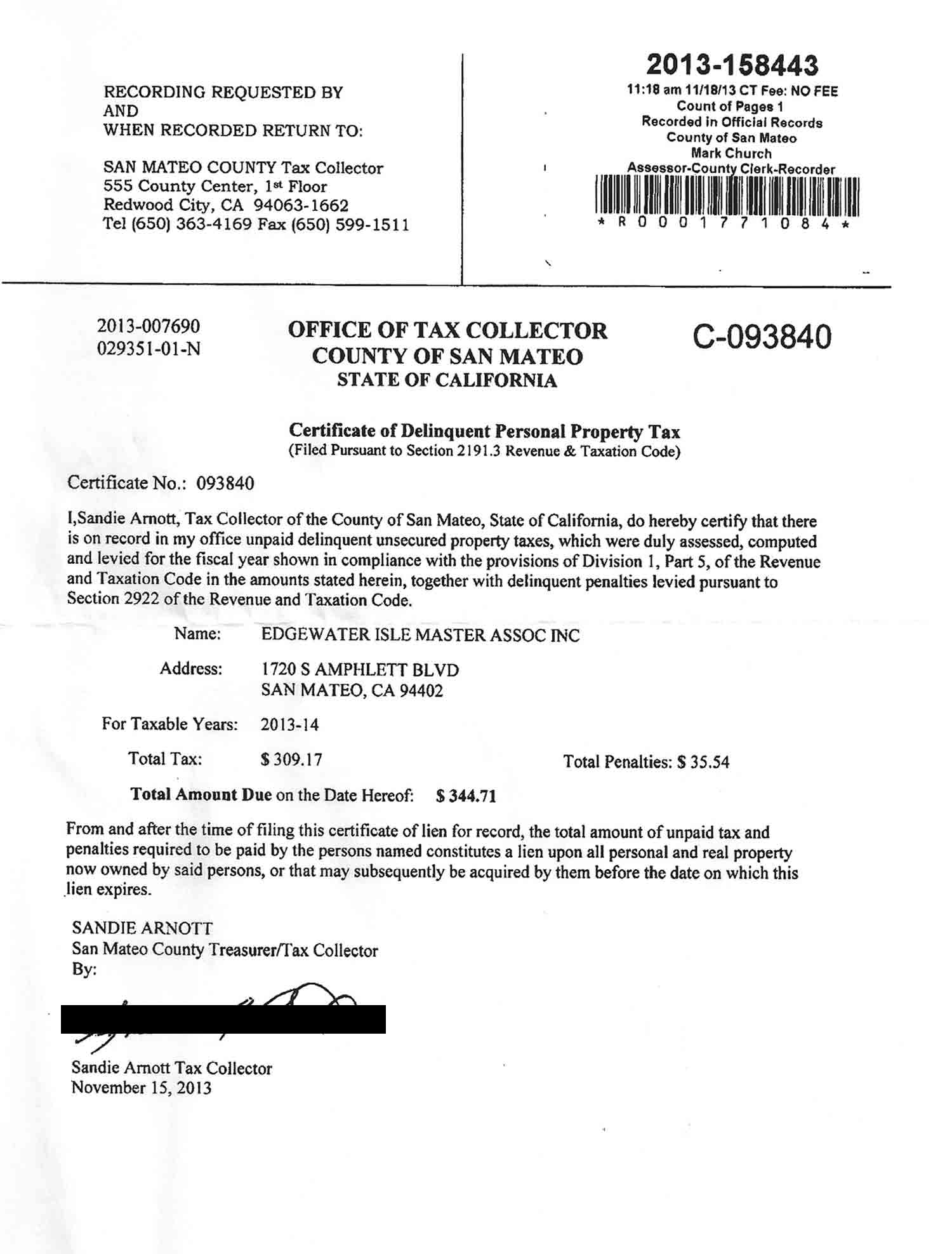

San Mateo County Issues Liens Against Master Association

San Mateo County Issues Liens Against Master Association

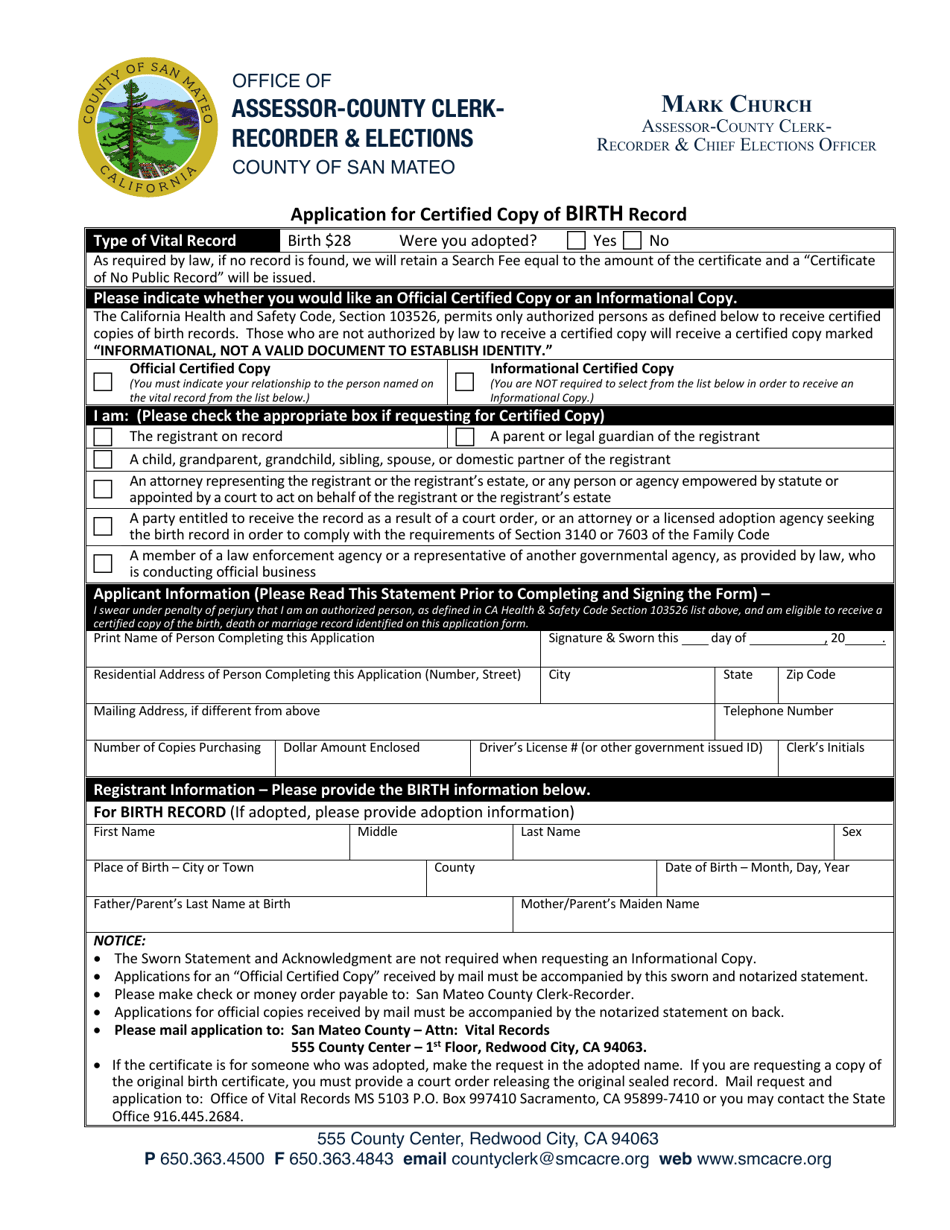

County Of San Mateo California Application For Certified Copy Of Birth Record Download Fillable Pdf Templateroller

San Mateo County Issues Liens Against Master Association

Sandie Arnott For Treasurer Tax Collector 2022 Pretty Proud Facebook

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

San Mateo County Property Values Reach Record High For 11th Year In A Row

San Mateo County Fair S Opening Gate Prior To Being Renovated Into The Lit Marquee San Mateo County San Mateo California San Mateo

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Online Services San Mateo County Assessor County Clerk Recorder Elections Acre

Charges On Property Tax Bill Montara Water Sanitary District